Latest news: Improve your tagging quality! - download and read our Tagging Quality Report - here

PREPARERS - get a comprehensive Assurance Report for your iXBRL accounts:

...and a full coverage report:

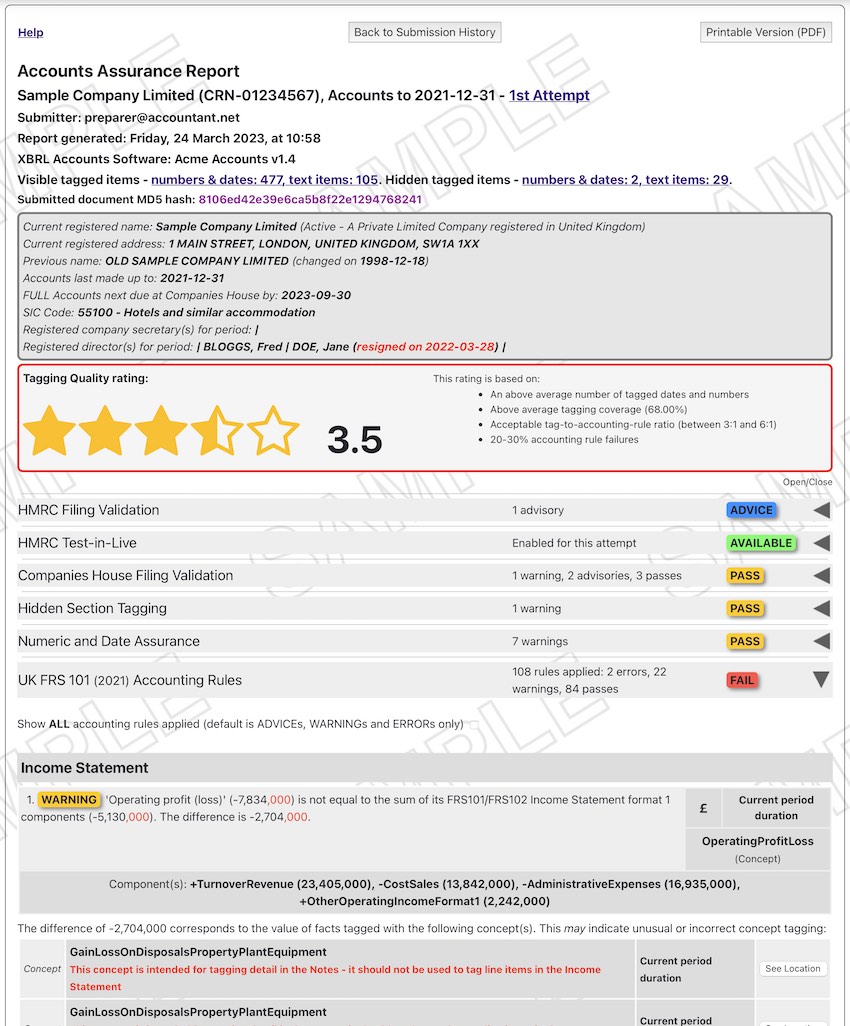

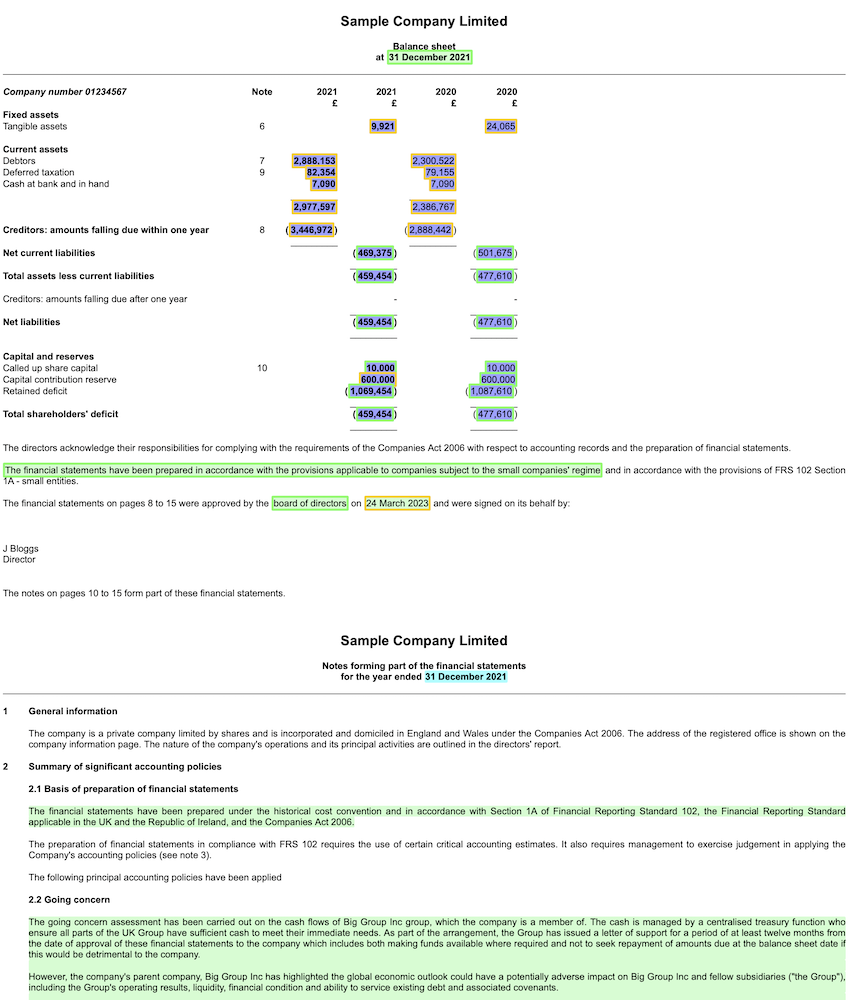

SureFile Accounts is a secure, independent and reliable online Quality Assurance testing service designed to help preparers of FRC-tagged iXBRL accounts.

SureFile Accounts uses the same core software as HMRC and Companies House to validate Inline XBRL accounts. However, on top of this, SureFile provides a range of tests to check the quality of tagging and the integrity of the accounts themselves.

It provides clear and informative diagnostics to guide users in fixing problems. These highlight the locations in accounts where tagging and/or content needs checking or amending. SureFile Accounts also uses clear language, avoiding the technical jargon and baffling obscurity of messages from government systems.

- It's an easy and very cost-effective means of strengthening assurance on the quality of tagging and data integrity.

- Helps preparers to avoid tagging gaps and errors that are likely to result in enquiries from HMRC or the Irish Revenue.

- Gives clear and informative diagnostics and provides guidance on fixing any problems in the form of an Assurance Report.

- Saves valuable time and effort in creating valid, self-consistent and high quality iXBRL accounts.

- Helps avoid costly last-minute problems revealed only when accounts are submitted to Companies House or put into a Corporation Tax Return and filed to HMRC or the Irish Revenue.

- A proven track-record processing more than 150,000 sets of accounts over the last 12 years.

SureFile Accounts' Benefits

Saves time and effort in reviewing iXBRL accounts and fits easily into XBRL review and assurance processes. SureFile quality checks will save taggers and reviewers substantial time by pointing to possible errors and avoiding the need manually to check various aspects of accounts. It can be used easily at any stage of the tagging and review process. Its reports can form part of the assurance process – providing evidence of the testing done. By purchasing 'per entity' testing, subscribers can run repeated checks on a single set of accounts as they improve tagging – all for one single, low payment. The improvement in iXBRL accounts quality and the saving of time and effort provided by SureFile will repay the low cost of subscription many times over.

Provides objective, measurable and reliable testing, which is independent of the software or organisations creating accounts in iXBRL. It also runs on secure, UK-based servers which ensure the confidentiality of your data and assurance reports.

Has a proven track record in helping preparers identify tagging and other errors in accounts. Over the last twelve years SureFile has been in constant use by preparers in accountancy firms large and small, responsible for the production and quality assurance of more than 150,000 sets of iXBRL accounts. SureFile's unique Tagging Quality score means that preparers have an objective measure of quality to continually rate their performance against and quantify their tagging process improvements.

SureFile Accounts is a secure, low cost, online service. You can sign up online for a single test attempt (just £10!) or save money by subscribing for a batch of tests. There are two charging options - per attempt, and per entity. With the former you pay for exactly what you use, no matter the entity or the period. With the latter you pay a fixed price per entity, per period, entitling you to upload as many attempts for that entity and period as you need to complete your QA and issue rectification cycles.